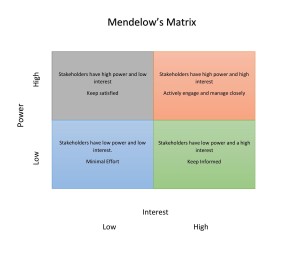

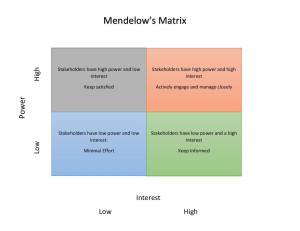

Mendelow’s Matrix is a tool that may be used by an organization to consider the attitude of their stakeholders at the start of a project or when they are setting out strategic objectives.

Continue to read the article below for a comprehensive explanation of Medlow’s Matrix and how to categorise stakeholders. If you would like more information on this and other MBA, business, finance, investing, and marketing topics, check out the Books and Resources section at the top of this page.

What are stakeholders?

A stakeholder is anyone, as an individual or a collective, such as an organization, that has an interest or is concerned with the actions of a business to the extent they are affected by it or can influence it.

A business is likely to have numerous stakeholders including directors, shareholders, employees, customers, creditors, regulators, the government and the community in which it sits.

A business will frequently find that different stakeholders have different priorities, which often leads to conflict. For example, an employee would like to be paid more. If this were to happen, this would reduce the company’s profits and would be to the detriment of the shareholder’s requirement of increasing profits and resulting wealth.

A business will therefore need to find a way to balance the conflicting priorities of its stakeholders. Mendelow’s Matrix is a tool that is used to analyse stakeholders and their attitudes. This will consider factors such as the level of interest a stakeholder has in a project or organization’s chosen strategies and whether are they likely to use their power to influence this.

Mendelow’s Matrix consists of four boxes representing stakeholders with:

- High Interest and High Power – These will be considered key players and a business will need to actively engage this group. This group are likely to have the most significant influence; they may be the driver behind the change or strategy. They will likely have the power to stop the change or strategy going ahead if they are unhappy.

This is the group that requires the most focus by keeping them both updated of any strategic change and empowered to steer the direction of change (or at least feel that they have the opportunity to input into the direction of the project).

- High Interest and Low Power – This group have an interest in what is happening, however they are unlikely to have the power to influence change. This group should be kept informed. Whilst they have little power themselves, they could attempt to join forces with a group with power.

- Low Interest and High Power – This group of stakeholders have the potential to move into the ‘High Interest and High Power’ group so it is essential that they are kept satisfied. By keeping them satisfied they are less likely to gain interest and exercise their power to influence.

- Low Interest and Low Power – This group is unlikely to have an interest in the organization and the strategic direction. This is often due to their lack of power to influence a situation. They are likely to accept the position and show little, if any, resistance.

What factors may dictate whether a stakeholder may exercise power?

If a stakeholder has a financial interest this will increase their level of interest in the company’s operations and future strategy.

An investor is a stakeholder who may consider their investment to be at risk, or not performing as expected unless the company produces good annual returns in line with the investor’s initial expectations. Investors with controlling interest in the organization are often in the top right quadrant of Mendelow’s Matrix because they usually have a high interest and high power.

An employee is also a stakeholder that could be considered to have a financial interest even if they have not personally invested capital. This is because their employment is their livelihood and they would not want to risk that. As an example, an employee may be averse to an organization investing in new technology to increase automation thus placing jobs at risk.

If a stakeholder does not have alternative options to dealing with or working with the organization, this would also increase their interest due to the fear of no immediate alternatives or fear of losing the benefits that the organization provides. An example of this may be where an organization is located in a country where labour rates are higher than in other countries. The stakeholders in the present country of operation may not wish to lose the benefits to the local economy that the organization brings and therefore do what they can to ensure that the organization does not relocate.

Likewise, an organization may supply a product that cannot be obtained elsewhere. Instances like this would increase customer interest.

If an employee lost their job, they may not immediately find another so employee interest would increase if their employment was considered at risk.

If an organization’s strategy is likely to have a high impact on the community that it is located; these strategies will generate interest with the potential to highlight these strategies to the stakeholders who have the power to influence. Examples of this would include job losses, which impact the economy or a change in processes that may impact on the environment or may create interest from individuals, councillors or community/environmental groups.

Does the stakeholder have the power?

Power is determined by whether the stakeholder can take action that will make an organization change in order to keep the stakeholder satisfied.

Employees can strike, and withhold their labour, which can be incredibly disruptive to an organization and its business, potentially damaging relationships with customers.

Customers can cancel orders if they no longer like, agree with, or support a supplier’s strategies.

Banks and other finance providers can call for repayment of overdrafts or loans.

Investors can withdraw their investments, especially if the organization’s approach to risk is no longer aligned with their own.