The beta value of a company (or even an overall value of a portfolio of companies) relates to the risk involved with investments made in the company. The beta value denotes how much ordinary internal and external factors can affect the company comparative to the whole of market. Therefore, a company with a beta of 1 may be said to perfectly correlated with the market. Therefore, investors would expect the value of a company’s stock to move in tandem with the market i.e. the market increases, the value of the company’s stock (if the beta was 1) would also increase relative to the market (perhaps after minimal lag period). Keep in mind that this a simple theory that must not be relied upon literally because there are many factors, foreseen and unforeseen, that can affect a company’s value. Keep reading for further information.

A company with a beta of 0.5 does not necessarily mean that if the whole market increased in value by 1%, the stock would only increase by 0.5%. The beta is a value that aims to determine how closely the value follows the whole of market rather than a specific numerical formula that can be applied to correctly determine the price of stock at any given time. The beta therefore describes the volatility of the stock. A beta less than 1 e.g. the 0.5 example means that the stock moves in price less than the market moves. A beta greater than 1 suggests that the stock moves more than the whole market fluctuates. Therefore, a company with a low beta may not move in value at all (or at least minimally) when the whole market fluctuates by small amounts). On the other hand, a company with a high beta may fluctuate in price by a percentage that is larger than the percentage market movement. A beta of 1.8, if no other factors are considered, would suggest that the price movement of a 1.8 beta stock would be magnified by 1.8 of the market move. The higher the beta, the greater the overall risk may be. Companies with a beta of 1.2 may be described as a moderate risk. Those with higher values e.g. 1.8 are considered much greater risk.

This does not mean that you should only select specific stocks based on beta. In fact, many professionals would say that beta alone is not enough for any informed investment decision to be made. Higher risk may mean higher reward if things go right. Some investors prefer high risk, high return strategies. What is right for one person may not be right for another. Investors with little margin for error may wish to deploy a strategy that has a lower growth/income rate, but aims to have an element of safety. Remember that no investment is completely safe. Stocks can go up and down for many reasons as can the whole of market. These include factors that are not directly related to the company performance, such as political events including the threat of terror or war.

As explained, beta relates to the market and not consumer behaviour that affects a particular company during anomalous trading periods.

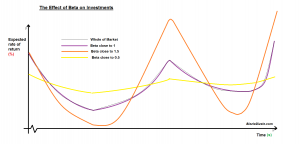

The following graph depicts the effect of beta on investment return in relation to the whole of market price fluctuation.

Beta is a value that is calculated considering the correlation coefficient between stock and market values. Many online financial websites provide the beta for most traded companies on the large exchanges. You will not need to calculate it usually unless it is asked for in an exam situation.

Read the Weighted Average Cost of Capital (WACC) and Capital Asset Pricing Model (CAPM) sections of this website in conjunction with this article.

When considering beta, professionals assess the objectives of their investments. Professionals (many MBA graduates) usually use a portfolio to spread risks rather than having ‘all eggs in one basket’. A portfolio may have many companies with betas in a similar range, but it also may have a spread based on a % that should be invested with less risk and a percentage that can have a greater risk associated.

This article is for information only. Do not take any action or use this in any way without checking with a suitably qualified professional first. Never use this website for any trading or investment decisions. The information is intended simply for reference that leads to further reading from a suitable textbook etc. This website does not make any financial recommendations.

Thank you for reading this article on BizzleDizzle.com! Please bookmark this page if you have found it useful.