WACC

The weighted average cost of capital (WACC) is the average return that a company would expect to pay to all its investors. Some investors will receive more and some less, but the WACC gives an overall picture i.e. each source of capital is proportionately ‘weighted’.

WACC is used in investing decisions. The higher the overall WACC, the greater percentage the company will pay on its finances, which denotes a higher risk. Risk may be due to volatile markets or as a result of raising finances in more turbulent economic times.

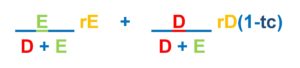

The calculation of weighted average cost of capital is relatively simple.

WACC =

E = Equity (current value of company’s total equity)

D = Debt (current monetary figure of company’s total debt)

tc = Corporation tax rate (the current corporation tax rate determined by the government)

rE = rate (% cost) of equity

rD = rate (% cost) of debt

Note: tc is a decimal i.e. 15% would be 0.15 and 8% would be 0.08