Double entry accounting is a principle where accounts are entered on two sides of a T account structure (explained below). Keeping accounts correct is a fundamental part of business. This not only provides information for tax affairs but also lets investors have a view of the company in terms of its operations, cash flow and trading style.

Double Entry Bookkeeping

Double entry bookkeeping is what forms the foundations of accounting. It is called double entry bookkeeping because every transaction requires two entries, one from the original ‘account’ and a corresponding entry to the destination ‘account’. This is in contrast to the alternative single entry system, which is used much less frequently.

A single entry system only recognizes one element of the transaction so fails to represent the position of the business as a whole. It is also much easier for an error to go undetected in a single entry system.

Double entry bookkeeping is based on the fundamental accounting principle of duality, the two entries required will be one debit entry and a corresponding credit entry.

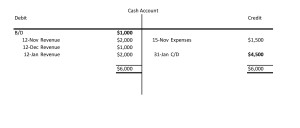

In very simple terms, think about a company buying stock using cash, you would see a credit entry in the cash account to reflect a decrease in the asset and a debit entry in the stock/purchases account to represent the increase in the asset.

Correctly recording the double entry ensures that the accounting equation is always balanced.

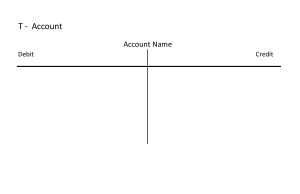

The entries in double entry bookkeeping take place in what is referred to as ledger accounts, these are sometimes called T accounts. The debit entries are on the left hand side and credit entries on the right hand side.

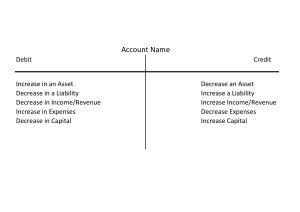

The entries follow a set of rules depending on the effect that transaction has:

1.

The Debit side will see entries to reflect the following:

- Increase in an Asset

- Decrease in a Liability

- Decrease in Income/Revenue

- Increase in Expenses

- Increase in Capital

2.

The Credit side will see entries that:

- Decrease an Asset

- Increase a Liability

- Increase Income/Revenue

- Decrease Expenses

- Increase Capital

You will see that these underpinning rules ensure that for each debit there is a corresponding credit entry and vice versa.

Usually, the transactions will initially be recorded in the Books of Prime Entry, these are sometimes called the journals. These will include the Sales Invoice Day book, Bank Receipts Day book, Cash Book, Sales Book. You will also see ledger accounts including trade debtor ledger, trade creditor ledger and bank ledger.

You have four types of accounts. These are Assets, Liability, Expenses and Income. Assets and Liabilities are the accounts that form a basis for the information contained in the Balance Sheet, the income and expenses for the basis of the Profit and Loss Account.

You will usually find a ledger account for each component of the balance sheet. After the end of a period you will close the ledger account and establish a balance carried down figure to start the following period, which will be referred to as a balance brought down.

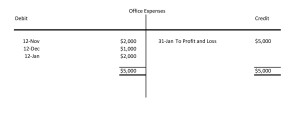

The components of the Profit and Loss Account will also have individual ledger accounts, the main difference between these and those relating to the Balance Sheet are that these do not have a carried forward figure or a figure brought down from previous periods, at the end of the period the ledger is closed and the amount charged to the profit and loss account.

At the end of the accounting period, a Trial Balance is completed. This is the process of posting the closing balances extracted from the ledger accounts.

Using an expense account as an example:

You may see multiple entries in the left hand column as multiple expanses have been recorded. In order to close this account, you will need to add the expenses together for the total, and balance the account with a corresponding credit entry to reflect the amount being changed to the Profit and Loss Account. The amount to be charged to the profit and loss account is shown as a credit entry, this will be reflected on the debit side of the Trial Balance.

When completing a trial balance, it is important to remember that a debit closing figure in the ledger will be posted to the credit side of a trial balance and a credit in the ledger will show as a debit in the trial balance.

This is a useful step in preparing accounts as it will ensure that the figures balance, all of the ledger accounts have been closed correctly and that all of the ledger balances are being included in the final accounts. It is also a useful tool to identify early errors, but is not foolproof, if wrong ledger accounts have been noted or the debit and credit entries are the opposite way round you will still have a trial balance that appears correct.

Hint

DEAD CLIC is an easy way to remember which entries should be a debit and which should be a credit. Debit entries represent increases in Expenses, Assets and Drawings. Credit entries represent increases in Liabilities, Income and Capital.