When considering whether a business should be invested in, a company or individual investor should assess the discounted cash flow (DCF). Discounted Cash flow determines the current value of a company, product, service or project based on its anticipated cash flows based on a discounted rate.

A discounted rate is used for one simple reason. The reason is discussed in many articles on this site and is a concept that must be understood but is often underappreciated or overlooked completely. The phrase ‘a dollar today is worth more than a dollar tomorrow’ is often used. Basically, money today is worth more than the same numerical amount of money in any future period.

Why is this?

The obvious one that many people may think about is inflation. Think about how much a car could be purchased for in 1970 – less than $1000; and that was for a luxury model with a German brand! However, there is also deflation (where the value of the currency increases in respect to the average purchased item). Deflation over any modern prolonged period has never been seen in the US or UK. There are some sectors that do not follow inflation figures exactly, for example, with global expansion some comparable items of clothing are cheaper now than they were 20 years ago. Overall though prices have increased in respect to all purchases. The cost of food, housing and fuel (such as automotive petrol and diesel) are prime examples of obvious inflation in many (most) countries.

There are reasons other than inflation when it comes to business. These include:

- What can the business do with the money today?

- Are there acquisitions or new services that need to be developed that are likely to product long term value?

- Can an investor use their money now to make more money e.g. investing in shares, another company, property?

- When something as simple and guaranteed as a government backed savings account with a reputable bank?

- Does the company need liquid cash to maintain its current sales?

See our article on cash flow for more insight into the cash needed to maintain operations.

One of the ways that investors can make an informed decision about which investments to make is by using the discounted cash flow to calculate how much future money can be generated from their current investments.

Here we have used the term current investments to describe the investments that could be made today i.e. the stocks and shares bought at their present value (PV). The present value is the value attributed to investment today.

Never think that there are simple formulas to predict the future, but by using discounted cash flow and other acknowledged models, investors may be able to make wiser choices. Remember that there are always unknown forces, for example, the impact that the unknown elements of ‘Brexit’ are having on the global economy.

Net Present Value

The term net present value (NPV) is on that is often used. Net present value is the future income from the investment minus the cost of the initial investment i.e.

NPV = PV – Cost of investment

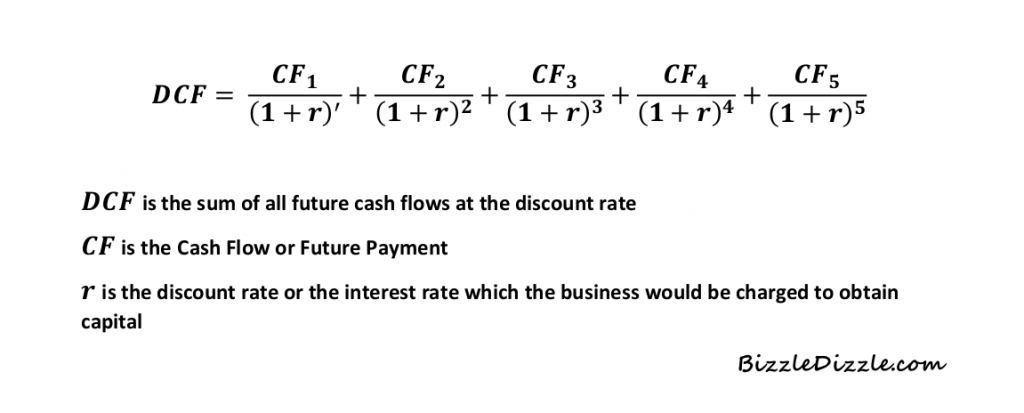

The Discounted Cash Flow (DCF) method of valuation applies a discount factor to the future cash flows to predict the present value of the cash flows and return generated. The discount rate is linked to the interest rate that the business would be charged to borrow capital.

Discounted Cash Flow Formula

The above formula utilizes the future value formula (discussed in another Bizzle Dizzle article). This is the application of the formula over a 5 year period.

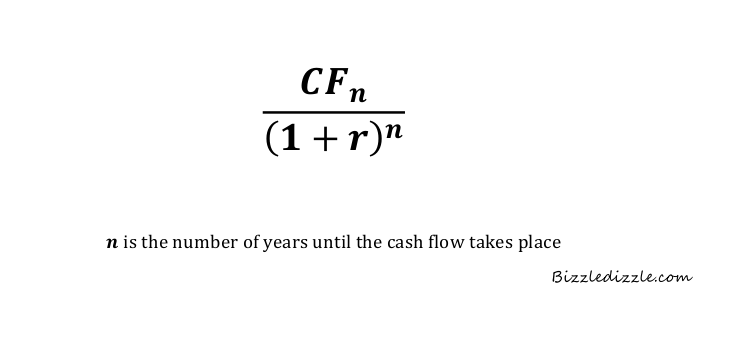

If we break the formula down the discounted present value (for one cash flow in one future period) is expressed as:

DCF Example

So, if we look at a simple example:

A business is considering a $100,000 investment, which is expected to generate a return of $25,000 for each of the following the 5 years, at first glance we may think, this is simple, $100,000 upfront, with a return of $125,000, of course they should invest. This ignores that well known saying mentioned earlier, that a dollar today is worth more than a dollar tomorrow.

So, what does the return really look like, if the business in question has an average cost of borrowing of 10%?

Initial Investment ($100,000)

Year 1 $25,000 /1.1 = $22,727

Year 2 $25,000/1.1^2 = $20,661

Year 3 $25,000/1.1^3 = $18,782

Year 4 $25,000/1.1^4 = $17,075

Year 5 $25,000/1.1^5 = $15,523

$94,768

In this scenario the NPV is minus $5,232, so would not be considered financially viable.

However, if the cost of capital was only 3%:

Initial Investment ($100,000)

Year 1 $25,000 /1.03 = $24,271

Year 2 $25,000/1.03^2 = $23,565

Year 3 $25,000/1.03^3 = $22,878

Year 4 $25,000/1.03^4 = $22,212

Year 5 $25,000/1.03^5 = $21,565

$114,491

NPV = $14,491

As a general rule any project or investment with a positive NPV should be considered as they are likely to be financially viable.